How Much Is Homeowners Tax Exemption . While kansas’s legislation increases the residential property tax. A homeowner exemption provides property tax savings by reducing the equalized assessed value. Granted, that’s not a huge amount of money per household; With property tax rates generally set at 1% of assessed value, the. While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. For example, for an owner.

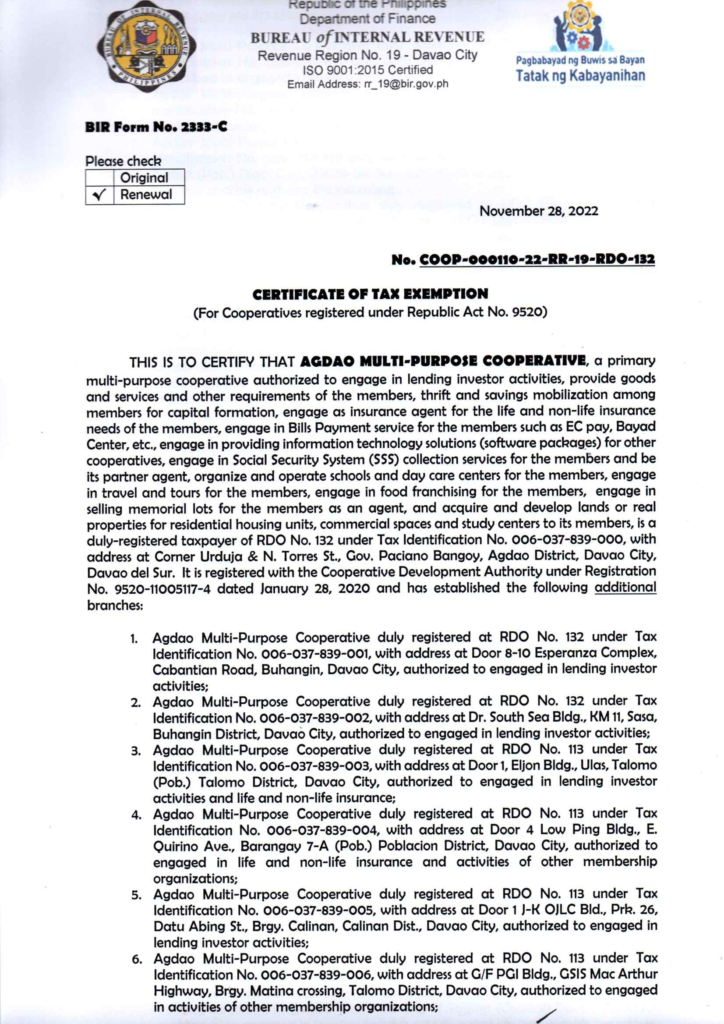

from agdaocoop.com

For example, for an owner. While homeowners can directly benefit from cuts in property taxes,. A homeowner exemption provides property tax savings by reducing the equalized assessed value. With property tax rates generally set at 1% of assessed value, the. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. Granted, that’s not a huge amount of money per household; While kansas’s legislation increases the residential property tax.

BIR Certificate of Tax Exemption AMPC

How Much Is Homeowners Tax Exemption Granted, that’s not a huge amount of money per household; A homeowner exemption provides property tax savings by reducing the equalized assessed value. While homeowners can directly benefit from cuts in property taxes,. With property tax rates generally set at 1% of assessed value, the. Granted, that’s not a huge amount of money per household; The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. While kansas’s legislation increases the residential property tax. For example, for an owner.

From filipiknow.net

How To Get a Certificate of Tax Exemption in the Philippines FilipiKnow How Much Is Homeowners Tax Exemption While kansas’s legislation increases the residential property tax. For example, for an owner. While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. With property tax rates generally set at 1% of assessed value, the. Granted, that’s not a huge amount of money. How Much Is Homeowners Tax Exemption.

From www.hauseit.com

What is the Basic STAR Property Tax Credit in NYC? Hauseit How Much Is Homeowners Tax Exemption Granted, that’s not a huge amount of money per household; With property tax rates generally set at 1% of assessed value, the. A homeowner exemption provides property tax savings by reducing the equalized assessed value. While kansas’s legislation increases the residential property tax. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective.. How Much Is Homeowners Tax Exemption.

From www.exemptform.com

HomeOwners Exemption Form Homeowner Property Tax San Diego County How Much Is Homeowners Tax Exemption The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. For example, for an owner. While homeowners can directly benefit from cuts in property taxes,. A homeowner exemption provides property tax savings by reducing the equalized assessed value. While kansas’s legislation increases the residential property tax. With property tax rates generally set at. How Much Is Homeowners Tax Exemption.

From www.youtube.com

Applying for your Homeowner's Exemption YouTube How Much Is Homeowners Tax Exemption With property tax rates generally set at 1% of assessed value, the. Granted, that’s not a huge amount of money per household; The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. While kansas’s legislation increases the residential property tax. While homeowners can directly benefit from cuts in property taxes,. For example, for. How Much Is Homeowners Tax Exemption.

From apexlg.com

Can My HOA get TaxExemption from the IRS? Apex Law Group How Much Is Homeowners Tax Exemption While homeowners can directly benefit from cuts in property taxes,. Granted, that’s not a huge amount of money per household; A homeowner exemption provides property tax savings by reducing the equalized assessed value. For example, for an owner. With property tax rates generally set at 1% of assessed value, the. The sarasota city commission doubled the local homestead tax exemption. How Much Is Homeowners Tax Exemption.

From arcc.sandiegocounty.gov

Homeowners' Exemption How Much Is Homeowners Tax Exemption Granted, that’s not a huge amount of money per household; While kansas’s legislation increases the residential property tax. While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized assessed value. With property. How Much Is Homeowners Tax Exemption.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson How Much Is Homeowners Tax Exemption The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. Granted, that’s not a huge amount of money per household; A homeowner exemption provides property tax savings by reducing the equalized assessed value. With property tax rates generally set at 1% of assessed value, the. While homeowners can directly benefit from cuts in. How Much Is Homeowners Tax Exemption.

From www.youtube.com

Homeowners Property Tax Exemption YouTube How Much Is Homeowners Tax Exemption The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized assessed value. With property tax rates generally set at 1% of assessed value, the. Granted, that’s not a huge amount of money per household; While homeowners can directly benefit from cuts in. How Much Is Homeowners Tax Exemption.

From www.formsbank.com

Application For Real Estate Tax Exemption For Elderly Or Permanently How Much Is Homeowners Tax Exemption For example, for an owner. Granted, that’s not a huge amount of money per household; The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized assessed value. While homeowners can directly benefit from cuts in property taxes,. While kansas’s legislation increases the. How Much Is Homeowners Tax Exemption.

From mauinow.com

Homeowners with Exemptions Reminded to File State Tax Returns Maui Now How Much Is Homeowners Tax Exemption While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. Granted, that’s not a huge amount of money per household; For example, for an owner. A homeowner exemption provides property tax savings by reducing the equalized assessed value. With property tax rates generally. How Much Is Homeowners Tax Exemption.

From www.charlescitypress.com

Senior homeowners urged to apply for new property tax exemption before How Much Is Homeowners Tax Exemption Granted, that’s not a huge amount of money per household; While homeowners can directly benefit from cuts in property taxes,. With property tax rates generally set at 1% of assessed value, the. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized. How Much Is Homeowners Tax Exemption.

From www.exemptform.com

HomeOwners Exemption Form Homeowner Property Tax San Diego County How Much Is Homeowners Tax Exemption While homeowners can directly benefit from cuts in property taxes,. While kansas’s legislation increases the residential property tax. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. Granted, that’s not a huge amount of money per household; A homeowner exemption provides property tax savings by reducing the equalized assessed value. For example,. How Much Is Homeowners Tax Exemption.

From www.countyforms.com

Cook County Tax Exemption Form 2022 How Much Is Homeowners Tax Exemption While homeowners can directly benefit from cuts in property taxes,. With property tax rates generally set at 1% of assessed value, the. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized assessed value. Granted, that’s not a huge amount of money. How Much Is Homeowners Tax Exemption.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word How Much Is Homeowners Tax Exemption While kansas’s legislation increases the residential property tax. While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. Granted, that’s not a huge amount of money per household; For example, for an owner. With property tax rates generally set at 1% of assessed. How Much Is Homeowners Tax Exemption.

From www.pinterest.com

What Is the Disability Property Tax Exemption? in 2020 Tax exemption How Much Is Homeowners Tax Exemption A homeowner exemption provides property tax savings by reducing the equalized assessed value. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. For example, for an owner. While kansas’s legislation increases the residential property tax. Granted, that’s not a huge amount of money per household; With property tax rates generally set at. How Much Is Homeowners Tax Exemption.

From hawaiivaloans.com

Attention Homeowners Submit Your Home Tax Exemption Application by How Much Is Homeowners Tax Exemption With property tax rates generally set at 1% of assessed value, the. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. While homeowners can directly benefit from cuts in property taxes,. While kansas’s legislation increases the residential property tax. A homeowner exemption provides property tax savings by reducing the equalized assessed value.. How Much Is Homeowners Tax Exemption.

From www.hauseit.com

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)? How Much Is Homeowners Tax Exemption With property tax rates generally set at 1% of assessed value, the. While kansas’s legislation increases the residential property tax. While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. A homeowner exemption provides property tax savings by reducing the equalized assessed value.. How Much Is Homeowners Tax Exemption.

From www.hauseit.com

What Is the NYC Disabled Homeowners' Property Tax Exemption? How Much Is Homeowners Tax Exemption While homeowners can directly benefit from cuts in property taxes,. The sarasota city commission doubled the local homestead tax exemption to $50,000 for some older homeowners, effective. While kansas’s legislation increases the residential property tax. With property tax rates generally set at 1% of assessed value, the. Granted, that’s not a huge amount of money per household; A homeowner exemption. How Much Is Homeowners Tax Exemption.